A Niche Within Private Equity

Week of October 11th Lower Middle Market Highlights

Welcome to the weekend and thanks to the 65 new subscribers who joined since the last edition. We’re the only news source tracking lower middle market M&A. Our goal is to keep you up to date on the latest information/transactions in the market and highlight market participants that are doing interesting things in the space.

This Week’s Feature

This week we’re uncovering the world of search funds and search fund investing. This niche of investing has picked up steam over the last decade but owes its roots to the 1980s, when a professor at Stanford University’s Graduate School of Business, H. Irving Grousbeck, originated the concept. The idea is that through an investment vehicle, investors can financially support an entrepreneur’s efforts to locate, acquire, manage, and then grow a privately held company.

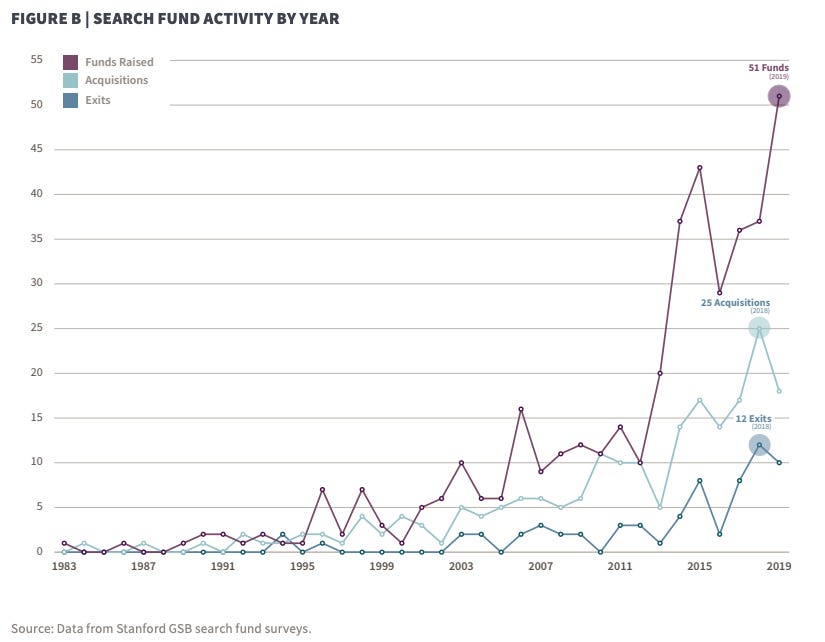

According to this 2020 Search Fund Study by Stanford’s Graduate School of Business, search funds are launching at record volumes. From 1984-2019, 401 search funds were formed in the U.S. and Canada, while 88 of them were launched between 2018-2019. Once upon a time, Harvard and Stanford were the only schools offering courses on search funds, but today that list has grown significantly.

Additionally, the 2020 study showed that during 2018-2019:

Average duration to complete an acquisition was 23 months

Median acquisition price was $10mm

Median EBITDA multiple paid was 6.0x

33% of searches ended without an acquisition

Independent Sponsors vs. Search Funds vs. Private Equity

There’s often some confusion as to the different private equity models. So what’s the difference between an independent sponsor, search fund, and traditional private equity?

One difference is that traditional private equity firms have raised a pool of committed capital in which they pull to acquire multiple companies. These firms have committed equity capital behind them and can invest in a company without outside approval from investors. Once a company is acquired, a private equity firm is involved in many aspects of the business but does not typically take control of day-to-day operations.

Independent sponsors and search funds act as fundless sponsors who raise funds on a deal-by-deal basis. Whereas an independent sponsor generally does not take on the day-to-day operations of a company, a search fund seeks to acquire a single business and then operate it. Additionally, a search fund raises capital from investors to fund the search process. In exchange, search fund investors receive the right, not obligation, to invest in the equity to finance the acquisition. These investors also receive the benefit of a stepped-up conversion of the search capital into the securities issued from the acquired company. This is a key difference between the two fundless sponsor types. Independent sponsors come in all ranges and sizes, some have incredible relationships with family offices and private equity and the ability to quickly close deals, while others do not. Conversely, a search fund has investors who have already committed search capital and thus have skin in the game. From a sell-side perspective, it can be more efficient for a search fund to close on a deal because of the investor pool that has already backed the searcher.

Search fund investors

The Stanford study cited above shows that $1.4b of equity capital has been invested in search funds since 1984. The aggregate pre-tax IRR for investors was 32.6% with a return on invested capital of 5.5x. It’s no wonder there has been a rush of firms to participate in these deals. We’ve compiled a list of active search fund investors below. Some firms listed solely focus on the search fund model, while others have layered on a search fund model into the firm’s overall private equity strategy:

Aspect Investors

Anacapa Partners

Search Fund Partners

Endurance Search Partners

Miramar Equity Partners

Alza Capital Partners

Pacific Lake Partners

Peterson Partners

Relay Investments

Granite Point Partners

WSC & Company

Futaleufu Partners

Bradford Brown Capital Partners

Ashford Venture Partners

The Cambria Group

Double R Partners

Graue Mill Partners

Housatonic Partners

M2O

ETA Equity

Maven Equity Partners

OPERAND GROUP

Liberty Search Ventures

Riviera Capital

Vonzeo Capital

Kinderhook Partners

Sage Capital Partners

Istria Capital

Hunter Search Capital

Greyhart Capital

Cerralv Capital

Cityfront Growth Partners

Mertal Family Partners

Saltoun Capital

Iron Creek Partners

Red Forest Capital

If interested in learning more, here are some additional resources that we have gathered:

2020 Stanford Business School search fund study Link

Searchfunder - the largest online search fund community Link

Search funds from the investor’s perspective Link

SearchFund.org Link

This Week’s LMM Activity

Search fund, Nova Vida, has acquired Ti Foods, a leading provider of Asian food products across Canada Link

Tide Rock Holdings acquires Pikes Peak Plastics Co. to grow plastics portfolio Link

Blackwell Capital acquires aerial equipment reseller, Stack Equipment Link

1847 Holdings acquires two companies to expand its cabinetry platform Link

Sunrise Treatment Center, a Bridges Fund Management portfolio co, acquires addiction treatment provider, Port 45 Recovery Link

Aries Capital launches new platform with the acquisition of Lyft’s Atlanta Driver Service Center Link

Longshore Capital Partners announces sale of Eclipse Advantage, a warehouse labor management company, to Two Sigma Link

Incline Equity Partners invests in residential cleaning services co, Perfect Power Wash Link

Andlauer Healthcare Group acquires Boyle Transportation, a transportation company to the life sciences industry Link

Fundraising

Balance Point Capital closes its sixth fund with $580mm in commitments Link

Genesis Park launches new $275 million fund Link

Other Stuff

Q3 US PE breakdown Link

Transforming how lower middle market healthcare firms are represented Link

Private equity funds, sensing profit in tumult, are propping up oil Link