Family Office Update and New Tax Proposal

Week of September 20th Lower Middle Market Highlights

Happy Friday and thanks to the 37 new subscribers who joined this last week. We’re the only news source tracking lower middle market M&A. Our goal is to keep you up to date on the latest information/transactions in the market and highlight market participants that are doing interesting things in the space.

This Week’s Update

In this week’s Axios Pro Rata, Dan Primack had an interesting update on the latest proposal with regards to the carried interest tax overhaul. In short, House Democrats want to increase the time horizon for when investments would qualify for long-term capital gains tax treatment. But the clock wouldn’t begin until substantially all of a fund’s committed capital is invested. This will have significant repercussions for both private equity and fundraising. Buckle up!

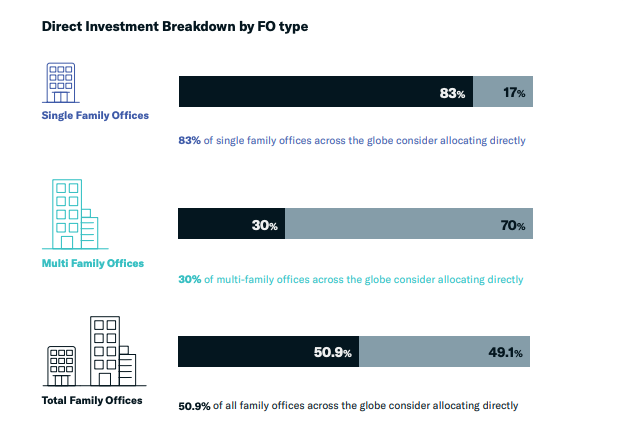

Speaking of private equity and fundraising, family offices are often seen as optimal investors due to their check sizes, efficiency, streamlining of decisions, and flexibility when compared to other groups of investors. FINTRX recently released a family office industry briefing and some of the direct investing data stood out. Highlights below:

More than three-quarters of family offices are invested in private equity, while just over half participate in direct investments

83% of single-family offices allocate towards direct investing vs. just 30% for multi-family offices

The regularity of direct investing continues to skyrocket, with more than two-thirds of family offices founded after 2015 actively participating in direct investment opportunities

Macro data highlights that when it comes to direct investments, family offices are heavily skewed towards participating in technology, consumer goods, business services, healthcare, and real estate opportunities

23.5% of family offices are participating in buyouts and acquisitions

In summary, we’re clearly seeing a pickup with direct investments in privately held companies, by family offices. This provides family offices with greater control over which companies are purchased and the timing of capital commitments and distributions. Additionally, direct investments come without the typical annual management fee and carried interest associated with most fund structures. The question remaining for family offices is how will they access private markets and how are they going to source investment?.. We happen to know a guy

This Week’s LMM Activity

Levine Leichtman Capital Partners portfolio co., Monte Nido & Affiliates acquires eating disorder treatment provider, Walden Behavioral Care Link

MiddleGround Capital acquires garage door component manufacturer, Arrow Tru-Line Link

Nexus Capital Management and Meaningful Partners invest in vitamin brand, Sugarbear Vitamin Care Link

Levine Leichtman Capital Partners acquires service provider for mission-critical infrastructure and equipment, In-Place Machining Company Link

Bregal Partners invests in gluten-free frozen food company, Oggi Foods Link

Kinderhook Industries sells collision repair company, ProCare Link

Kinderhook Industries-backed All States Ag Parts acquires agricultural and construction parts supplier, Summit Supply Link

Graycliff Partners buys Electro-Mechanical Corporation Link

Center Rock-backed LINC Systems adds on Air-O Fasteners Link

Housatonic Partners and Pracinco Management invest in cloud and digital transformation services co., Veridic Solutions Link

Surge invests in home improvement and remodeling lead-gen platform, Contractor Connect Link

Weinberg Capital Group acquires outdoor apparel co., Drake Waterfowl Systems Link

Fundraising

Levine Leichtman Capital Partners’ Fund III oversubscribed with $1.38B of commitments Link

Clearhaven Partners raises $312M in debut software and tech-focused fund Link

Other Stuff

LPs say direct investments offer the best risk-return tradeoff Link

Who owns your life insurance policy? It might be private equity Link

PE rethinks sports investing strategy after fans and teams cry foul Link

When Wall Street came to coal country: how a big-money gamble scarred Appalachia Link