9x is the New 7x and More

The First Edition of The Lower Middle Market

Welcome to the first edition of The Lower Middle Market.

Even though SPACs are stealing recent headlines, the LMM remains a hot area in the M&A transactions market. A recent PitchBook presentation shows that ~70% of 1Q20 deals were for companies with valuations <$100mm. This seems to be consistent with what we’ve seen since 2011.

Why is so much volume concentrated in the lower middle market? For one, the combination of high growth prospects and lower valuation improves the risk profile of attractive companies in the segment. The rising age in the boomer generation also makes family-owned companies, with no transition plan, attractive targets as owners reach retirement. Additionally, many owners are in a hurry to exit before facing a potential rise in taxes or worse yet, a recession. Another reason, as discussed below, is add-on acquisitions catching fire.

The add-on boom continues to heat up. ~60% of PE deals were classified as add on’s during 1Q21.

What’s driving this? With add-ons, PE is able to deploy capital with fewer risks involved than a platform investment. The increased liquidity in the market means PE doesn’t have to hold these companies as long as they used to. The financial services sector is a prime example of this dynamic at play - in the insurance market, 80% of all deals were driven by add-ons. In PitchBook’s Q&A section of the report with Plante Moran’s Michele McHale and Ted Morgan, it was mentioned that,

“fund managers are currently focusing on technology services and add-on versus platform-focused growth. In businesses wherein labor is the primary expense, managers are focused on staffing and utilization and looking for tools that can help manage their people more effectively.”

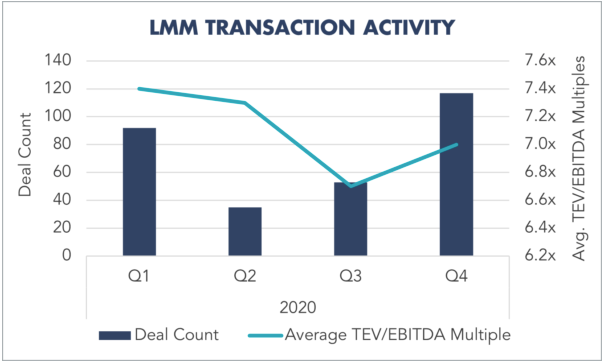

All of this equates to a healthy deal market, with EBITDA multiples heading to all-time highs. According to SDR’s recent LMM report, 4Q20 valuations rose to 7.4x EBTIDA.

This checks out with what we’re hearing, as a recent advisor, who lead the deal on an HVAC company with $2mm in EBITDA, relayed that the company sold for 9x EBITDA! There was a joke a few years ago that 7x is the new 5x. It seems like that has been surpassed by 9x being the new 7x.

The Lending Picture

Garrett Ryan, head of capital markets at lower middle market lender Twin Brook Capital Partners, recently joined the Middle Market Growth podcast to discuss how deal activity and lending have evolved since last March.

Overall, it’s been an interesting turn of events from a year ago. Ryan highlighted that the initial pandemic levels saw leverage at 1x lower than pre-pandemic levels, with pricing 150-200 bps higher. Additionally, no underwriting risks were taken. There was huge call protection on debt along with small holes on lenders who were willing and able to provide debt. Fast forward a year later, and he’s now seeing more aggressive conditions for lenders and private equity, even when compared to pre-pandemic levels.

Ryan maintains he’s bullish on the rollout of new platform investments for Q2 and beyond, as a number of parties revisit exits that were put on hold due to COVID. He thinks the timing seems right to bring a company to market. There are opportunities for not only businesses that demonstrated strong financial results during COVID, but those that display how they are better positioned now, post-COVID, through the changes they made during last year to position themselves as better businesses. He thinks many are primed for sale as businesses look to healthy equity and debt markets to support the sales process. Ryan expects a robust next 2-3 months in LBO/platform acquisitions, with add-on investments showing no signs of slowing down.

He thinks sectors that struggled during COVID (e.g., transportation, events) will continue to see lower levels of leverage. On the flip side, sectors such as distribution, food services, financial services have elevated themselves, which will attract more interest from PE and direct lending communities.

You can listen to the full interview here.

Elsewhere, Cerebro Capital recently released its 1Q 2021 survey on non-bank lending for middle-market commercial and industrial loans.

Here were some of the highlights from the report…

More Flexible Loan Covenants: Nearly 20% of both commercial bank and non-bank lenders have eased loan covenants and structuring. Though some lenders are providing more flexible structures than typical to win market share, other lenders are offering structures that resemble pre-covid lending structures, representing a relaxed approach compared to the past six months.

High M&A Activity: 56% of commercial banks and 73% of non-bank lenders reported M&A as a key driver to new loan demand in 1Q21. However, of all the reasons driving demand for non-bank lenders, M&A activity had the largest number of lenders (48%) indicate that it is a "very important" factor. This trend continues on from 4Q20 during which M&A activity started to pick-up.

Larger Loan Sizes: 34% of non-bank lenders have increased loan sizes over the past quarter compared to only 22% of commercial banks. Non-bank lenders have been more aggressive on increasing loan sizes for their clients as the economy improves and competition heats up.

Lower Interest Rates: Approximately one-third of both commercial bank and non-bank lenders have indicated that they have lower interest rates over the past quarter for new loans. In general, the credit markets have begun to relax as risk of lending has decreased in the anticipation of the economy reopening.

More Flexible Loan Covenants: Nearly 20% of both commercial bank and non-bank lenders have eased loan covenants and structuring. Though some lenders are providing more flexible structures than typical to win market share, other lenders are offering structures that resemble pre-covid lending structures, representing a relaxed approach compared to the past six months.

Optimistic Outlook for Easing Loan Terms in 2021: Looking ahead for the remainder of 2021, nearly 40% of non-bank lenders surveyed anticipate continuing to ease loan terms. The primary reason for this outlook is that 60% of these lenders expect increased competition for high-quality corporate borrowers, requiring more aggressive actions to win new business.

You can download the full report here.

Recent LMM Activity

Sheridan Capital Partners announces investment in DAS Health

Sheridan invests in Simione Healthcare Consultants and BlackTree Healthcare Consulting merger

CenterGate Capital partners with Leading Lawn and Garden Platform

LFM Capital portfolio company J&E Precision Tool acquires Alloy Specialties and Beranek

Osceola Capital completes acquisition of Zoneez Power Washing & Window Cleaning

Osceola Capital’s portfolio company Top Gun Facility Services acquires Emerald Isle Landscaping

New Water Capital sells fresh, prepared foods manufacturer Custom Made Meals

Godspeed Capital makes strategic investment in Prime Engineering

Granite Creek Capital Partners announces investment in beverage company Big Easy Blends