The Lower Middle Market 4Q22

Happy New Year and welcome to our 2022 4th quarter review of The Lower Middle Market. We’re the only news source tracking lower middle market M&A. Our goal is to keep you up to date on what’s happening in the market by highlighting the latest news, transactions, and activity.

Temperature Check

Coller Capital recently shared its 37th Coller Capital Global Private Equity Barometer. While many of the investors polled still find the asset class attractive, it’s clear there has been a drop in bullishness since the last poll, 6 months ago. Some of the highlights include:

PE and private credit are viewed as more attractive by LPs than public markets in volatile times

The macroeconomic environment and inflation are LP’s top concerns over private equity returns for the next 2-3 years

More LPs are investing in PE energy assets than four years ago, in both renewables and hydrocarbons

One-third of LPs plan to increase allocation to alternatives over next year vs. one-half, 6 months ago; Fewer LPs are planning increases in allocations to private equity

The number of LPs forecasting that their private equity portfolios will achieve

returns greater than 16% is at the highest level since the winter of 2011-2012

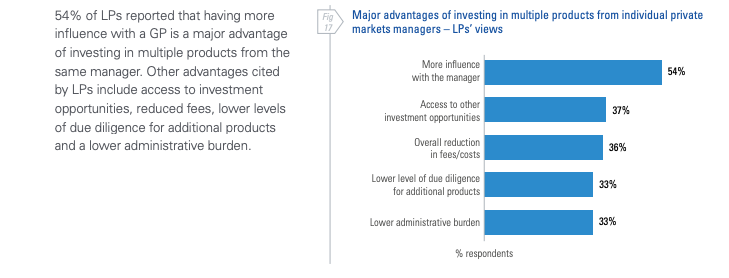

Gaining more influence with a GP is seen as a major advantage:

Only 5% of LPs say they are likely to change the balance of new private market funds in response to opportunities created by the Biden Administration’s recent Inflation Reduction Act

Click here to access the full report.

Add-Ons Popularity on the Rise

Over the last year, add-on investments have been adding up. According to Pitchbook, add-on activity accounted for 72% of all PE middle-market buyouts in Q3. Most platform activity has slowed down tremendously due to the macroeconomic environment: geopolitical issues, inflation, rising interest rates, supply chain instability, and other issues. In other words, investors are becoming risk averse leading to smaller investments. As the frothy market conditions of 2021 give way to the new reality of current market conditions, conservative strategies will continue to gain steam. As a result, additional reliance on value creation will play a pivotal role and should see the increase in add-on activity continue in 2023. Particularly, as firms wait out a cooler credit and deal-making environment.

Related Reading:

Most Active Investors

We tracked over 170 lower and middle market transactions in 4Q22. The most active firms were Incline Equity Partners and The Riverside Company. Both firms were busy and participated in five transactions each.

Incline Equity Partners:

Acquired Icreon, a digital transformation services company (New Platform)

Acquired Intech Equipmet and Supply, a spray polyurethane foam company (Add-on to its Specialty Products and Insulation Platform)

Acquired iWave, a data-driven insights company for non-profits (New Platform)

Acquired Norkan Industrial Supplies, an asbetors & mold abatement supplies provider (Add-on to its Jon-Don Platform)

Acquired CRT Industrial Equipment, an industrial cleaning equipment provider (Add-on to its Jon-Don Platform)

The Riverside Company:

Acquired Oberon Company, an Arc Flash PPE product manufacturer (Add-on to its SureWerx Platform)

Acquired First Advantage Consulting Firm, a consulting firm specializing in Affirmative Ation Plans (Add-on to its OutSolve Platform)

Acquired Canuti Tradizione Italiana, a frozen pasta distributor (Add-on to its Il Pastaio di Brescia Platform)

Acquired BioDue, a dietary supplements and medical devices company (New Platform)

Acquired Applied Educational Systems, an online education service provider (Add-on to its iCEV Platform)

Top Add-On Activity

With add-on activity generating a lot of buzz on the quarter, a couple of platforms led the way when it came to M&A volume in the quarter.

CPS Capital-backed Royal House Partners was busy buying businesses in the HVAC, plumbing, and electrical services space. The firm added on four home services businesses during the quarter.

NMS Capital’s U.S. Foot & Ankle Specialists platform acquired four podiatry/foot & ankle centers.

Fundraising

Resurgens Technology Partners raised $500 million for software-focused Fund II Link

Union Capital Associates raised $309 million for 3rd fund Link

LongueVue Capital closed LVC IV, a $360 million private investment fund Link

Clearview Capital completed fundraising for Equity Fund V Link

Kuwait’s state-backed Wafra raised $1.5 billion for lower-mid market companies Link

AAVIN raised $63 million yaking investable capital to $189 million for small businesses Link

ACP raised $620 million Fund III Link

Kindhook Industries closes Fund 7 at $1.85 billion Link

American Pacific Group announced Fund II Link

Thoma Bravo raises $6.2 billion Explore Fund II for lower middle market investments Link

VSS Capital Partners closes VSS SC Fund IV to invest in healthcare, education, and business services companies Link

Sentinel Capital Partners closes $5.2 billion Fund VII Link

Manhattan West raises inaugural fund to focus on LMM companies Link

Other Stuff

CAPX: The new digital platform aimed at eliminating the inefficiencies in approaching middle market debt capital Link

With a recession looming, PE angles for opportunities in 2023 Link