Why the Naval Ship Ecosystem is Heating Up

Lower Middle Market January 2024 Edition

Welcome to this month’s edition of The Lower Middle Market. Even though consensus seems to be that the 2024 M&A market will pick up with the expected decrease of interest rates, many participants seem to be in a holding period. However, we do have a handful of tidbits and news to pass along including:

Investors are suddenly interested in the naval ship ecosystem

Recent highlights and lowlights of healthcare

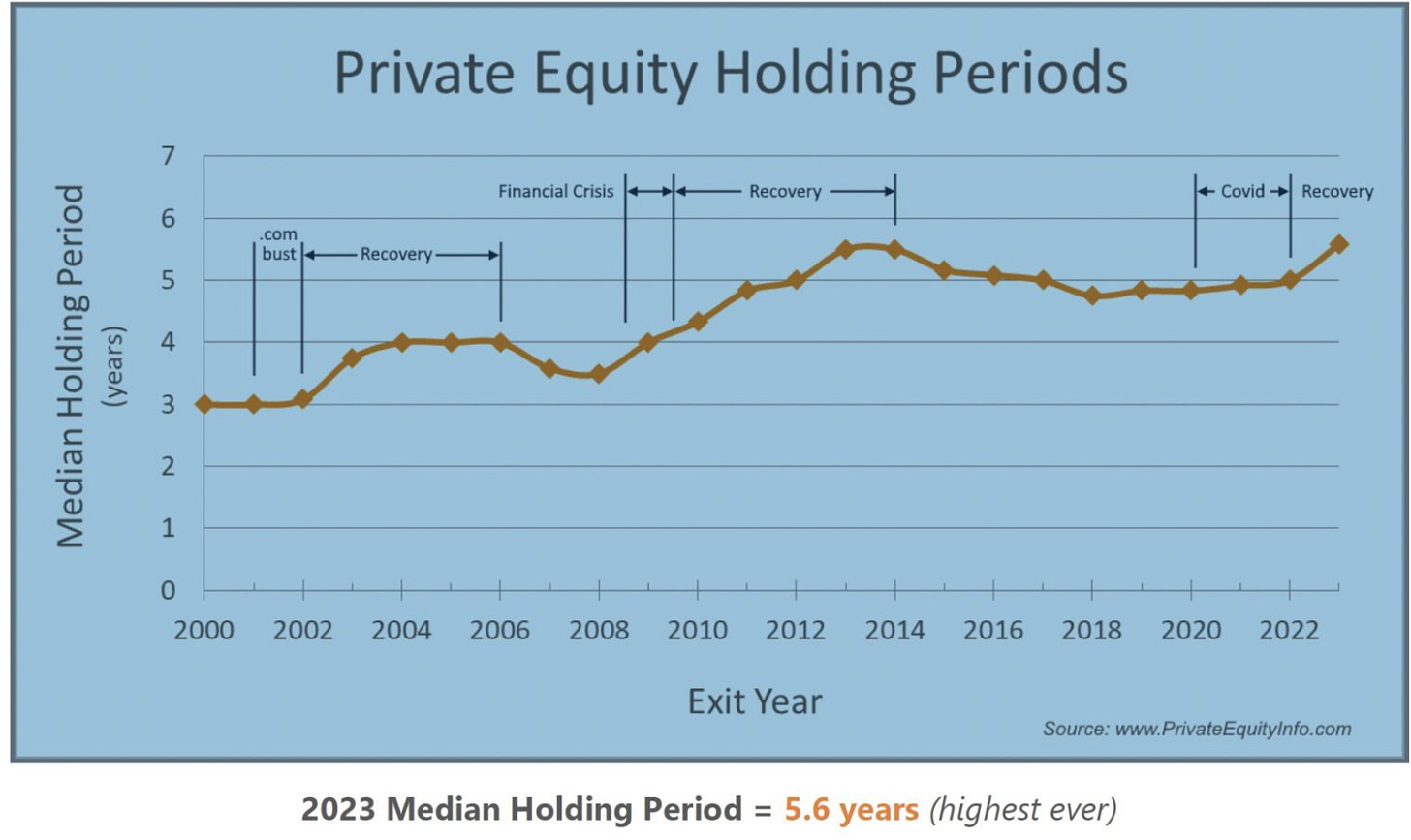

What’s going on with private equity holding periods?

Let’s get into it!

What’s Hot

Naval Ship Ecosystem - An emerging niche within the naval ship ecosystem has emerged due to the $11 billion year over year increase to the Department of Navy’s FY24 request. Expected industries to ride off this tailwind include naval ship maintenance, repair and operations (MRO) and modernization. Link

Divestitures - According to this Pitchbook article, carveouts and divestitures are expected to rise in 2024. With expectations that soft conditions in the LBO market will persist in 2024, PE sponsors will continue to rely on tools that optimize their existing assets rather than seek out new platform investments. Link

High Growth Pharma Companies - Clinical trial companies have been a bright spot with EBITDA multiples as high as 20x in recent deals. Other adjacent areas that are showing signs of life with attractive multiples include clinical research organizations (CROs), contract development and manufacturing organizations (CDMOs), and healthcare research and data companies Link

What’s Not

PE-backed Hospitals - Speaking of healthcare, a recent study by Harvard Medical School and University of Chicago researchers shows hospital patients are more likely to fall or acquire infections inside of private equity-owned facilities than in peer facilities Link

Holding Periods - The median holding period for PE-backed portfolio companies is now 5.6 years, the highest value since Private Equity Info began tracking it in 2000. Link

Fundraising

Shorehill Capital Raises $260 Million to Focus on Industrial Companies Link

Tower Arch Capital Raises $750 Million Fund III Link

Taurus Private Markets Closes Second Lower Mid Market Fund Link

Falfurrias Raises $400 Million for Growth Focused Software and Business Services Companies Link

Turnspire Capital Partners Closes $275 Million Fund for North American LMM Industrial and Consumer Businesses Link

Clearhaven Partners Raises Sophomore Fund for LMM Software and Tech Companies Link

Falfurrias Growth Partners Raises $400 Million For Lower Middle-Market PE Fund Link

Cleveland-based Edgewater Capital Closes 5th Fund Link

NewSpring Raises $180 Million for Healthcare Fund Link

Seven Hills Closes $125 Million Inaugural Fund Link

Forward Consumer Partners Raises $425 Million Debut Fund in Search of Branded Consumer Companies Link

Leavitt Equity Raises 3rd Healthcare Focused Fund Link

Bertram Capital Raises $1.5 Billion for its Fifth Fund Link

Other stuff

The Way Companies Borrow Money is Changing Forever Link

Permanent Equity’s Annual Letter Link

An Interview with Thayer Street Partners’ Josh Koplewicz Link

Thanks for reading and have a great end to the week!